ABOUT US (Who We Are)

Maurya Wealth: Your Path to Financial Success

At Maurya Wealth, we understand that managing your finances can be complex, but it doesn’t have to be. With over 5 years of trusted experience, we offer a comprehensive suite of financial services designed to help you build, manage, and protect your wealth:

Equity Broking: Buy and sell stocks with confidence through our expert broking services, designed to maximize your returns while managing risk.

Mutual Funds: Diversify your investments with the right mutual fund options, tailored to your risk tolerance and financial objectives.

Insurance: Protect your family, assets, and future with the best insurance solutions that meet your specific needs.

Retirement Planning: Start planning today for a secure and comfortable retirement tomorrow with our retirement planning strategies.

Portfolio Management: Let our experts create and manage a well-balanced portfolio that aligns with your financial goals, helping you grow wealth efficiently.

Tax Savings Products: Maximize your savings through tax-efficient investment products designed to help you minimize liabilities and grow wealth.

Financial Consulting: Receive personalized advice on budgeting, investments, and other financial matters to make smart decisions at every stage of your life.

At Maurya Wealth, we focus on understanding your unique financial situation and goals. We believe in offering tailored solutions, backed by transparent advice and a customer-first approach. Whether you’re just starting out, planning for the future, or looking to optimize your portfolio, we’re here to support you.

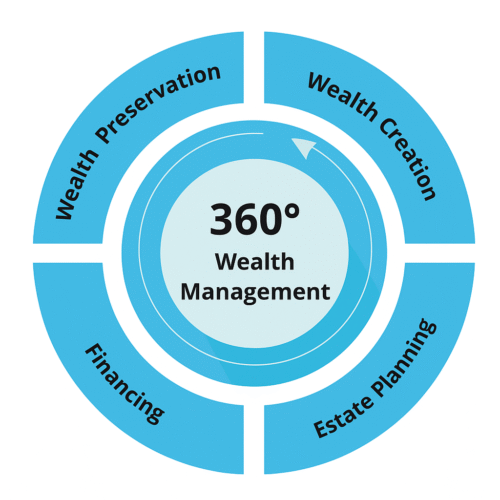

Our 360° Services

We provide a complete range of financial services to help you achieve your goals with confidence.

Services (You've Got Goals, We've Got Solutions)

Trading & Investment Services

Diversified Asset Management

Portfolio Management Services

Securing Life & Retirement Services

List of Services

Mutual Funds

Equity Broking

PMS (Portfolio Management Services)

AIF (Alternative Investment Funds)

LAS (Loan Against Securities)

Corporate FD

TAX Planning

Insurance Advisory

NRI Investing

SIP/Lumpsum Calculator

12%

10 Years

Invested Amount: ₹0

Estimated Returns: ₹0

Total Value: ₹0

Why Choose Us ?

Customer Centric Approch

Tailor Made Advisory

Easy to Manage Funds

Tech - AI Driven System

Frequently Asked Questions (FAQ)

Find answers to the most common questions we receive.

When should I start investing?

+

The best time to start investing is as early as possible to benefit from compounding.

How do I choose the right mutual fund?

+

Consider your goals, risk appetite, fund performance, and expense ratio.

Can NRIs invest in India?

+

Yes, NRIs can invest in India through NRE/NRO accounts and eligible investment options.

What is Financial Planning?

+

Financial planning involves managing your income, expenses, and investments to meet your goals.

What are the benefits of Portfolio Management?

+

It helps diversify investments, reduce risk, and optimize returns based on your goals.

How can I plan for retirement?

+

Start early, estimate retirement needs, and invest regularly in retirement-focused instruments.

Copyright © 2026 mauryawealth.com | Powered by mauryawealth.com l All Rights Reserved.